Table of Contents

More and more people are making money transfers via mobile apps. This is explained, first of all, by convenience and reluctance to use cash. Having a smartphone, a user can make a transfer to anywhere in the world at any time of the day. The sphere of financial mobile solutions is actively developing, offering the user more and more unique opportunities. If you are looking for a fintech app development guide, we recommend that you read this article about the features of creating applications for money transfers.

What are P2P Apps?

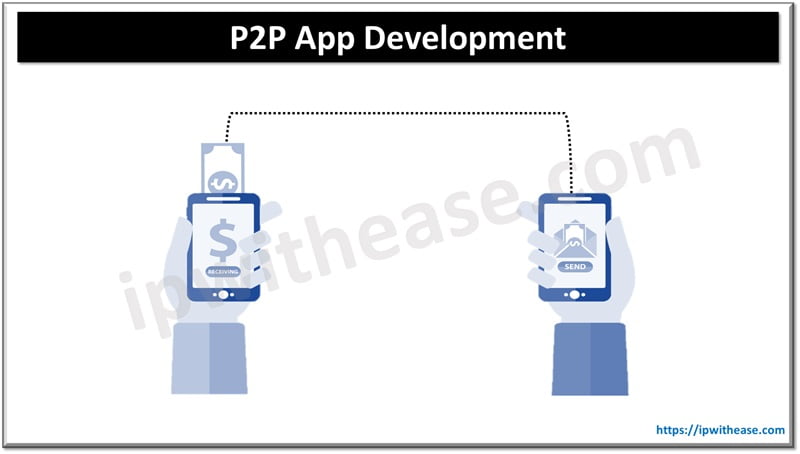

Peer-to-peer (P2P) payments are transactions sent online or via a mobile app. P2P transfers can be payments for car rental, lunch, or a taxi ride. The user can use the mobile app to quickly manage funds from their bank account or credit card.

The first service in the P2P transfer sector is PayPal. Today, it is used in many countries. However, many other platforms are entering the global P2P app market.

P2P app payments allow you to transfer funds between bank card holders, even if they are clients of different banks and different payment systems, such as Visa or MasterCard.

How Does a P2P Payment App Work?

Creating an account in a transfer app is quite simple. It does not matter which platform you use, you need to register an account and then link your card to the service account. Most apps ask users to provide certain personal information, set passwords, and verification words. Once all the information is entered and verified, the user can search for their friends and relatives by phone number or email and send them funds.

To send or receive money, users need to make a few clicks. You need to select the recipient, and the amount of money, add a payment purpose if necessary, and click the Send button. In most cases, you need to enter a password to confirm the transfer, as this is an additional layer of protection. The delivery time of funds can vary – a couple of minutes or several days, depending on the service and transfer option you use. Once the funds are delivered, the user can, if necessary, withdraw them to a personal bank account.

Reasons to Build a Money Transfer App

To start building a P2P app, you will of course need to find a reason to do so. Otherwise, why not use ready-made solutions?

First, with your P2P app, you can offer users something unique and unusual that they will not find in other services. For example, you own a financial institution that requires a P2P payment service for internal use. A customized solution can include all the functionality that is specifically needed to solve your business problems.

P2P app payments have the advantage of being cost-effective. This means there are no intermediaries. Financial transactions are carried out digitally, directly between the sender and the recipient of funds. There is no need to involve third parties in the process, which also reduces transaction costs.

Users also value transparency. If you need to exchange currencies, the user is more likely to see a good rate in the payment app, which is determined by general demand, not by the bank.

Generally, all P2P payment apps are quite secure. Since they are financial software, developers add several layers of protection to encrypt transfers and ensure that attackers fail in their attempts to steal money.

It is impossible not to mention that modern applications for transferring funds support the anonymity function. This factor is especially important for those users who work with cryptocurrency.

Steps to Create a P2P Payment App

Let’s take a quick look at the steps you need to take to create a P2P payment app.

1. Choose the type of P2P payment app.

First, you need to choose the type of app. It can be a bank app with different features or an app for transfers only.

2. Choose a mobile platform.

At the start, especially with a limited budget, you can focus on developing an app for one mobile platform. This can be either Android or iOS. As the project develops, you can allocate a budget for developing another app.

3. Create the functionality.

In addition to the features that an MVP should have, it is important to focus on the unique features that will differentiate your solution from competitors. It all depends on what user requirements you are ready to satisfy.

Functions of P2P App

Among the main functions of the P2P application:

- digital wallet;

- sending and requesting money;

- sending invoices/invoices;

- push notifications;

- unique ID/OTP;

- transfer to a bank account;

- admin panel;

- chat;

- history.

4. Security is the main factor.

The most important thing that users of financial applications value is data security. Make sure that the application supports all modern security measures:

- Add security features: All built-in security features in mobile devices should be enabled. Fingerprint scanners, facial recognition, and other technologies should be used. However, if the user’s device does not support this feature, two-factor authentication should be enabled;

- Two-factor authentication: In addition to the password, another authentication method is required for authorization, for example, SMS with a verification code.

- PCI-DSS compliance: If you are developing a fintech application, then PCI-DSS compliance is mandatory.

5. Attention to UI/UX.

The UI and UX of a financial app should be as simple and clear as possible. Users don’t need an app that takes a lot of time to register and understand how it works. We recommend not to complicate the design, but to focus on implementing hints for users.

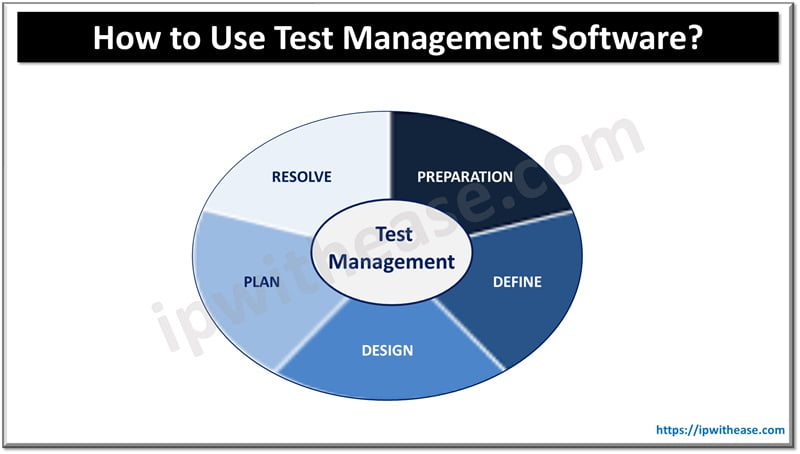

6. Testing the application.

Testing is important for any application, especially for those focused on financial services. To release the application, it is necessary to conduct all the necessary types of testing, which will make sure the application is secure. In addition, it is recommended to involve users in testing the application, who will conduct beta testing. This step will allow you to detect and fix existing errors at an early stage.

Wrapping It Up

Creating a money transfer app is a promising idea, given the demand for fast and secure financial services. However, the success of such a project will depend on a thorough market analysis, understanding the needs of the target audience, and implementing innovative solutions that will make the app unique and useful for users.

ABOUT THE AUTHOR

IPwithease is aimed at sharing knowledge across varied domains like Network, Security, Virtualization, Software, Wireless, etc.