Table of Contents

Importance of Secure Payment

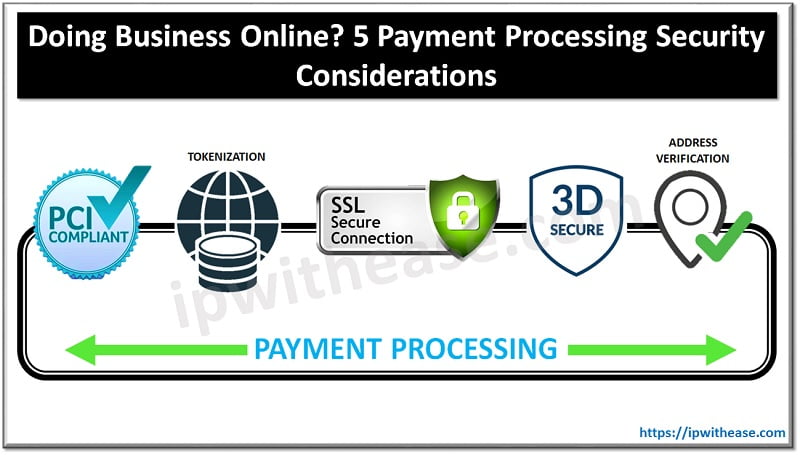

Part of doing successful and, importantly, repeat online business with your customers is providing them with secure payment processing. Whether you’re evaluating different options through a payment gateway comparison or simply seeking to tighten security, even one stolen credit card or a data leak can tank your reputation. With that in mind, below are 5 payment processing security considerations to keep in mind.

Are You PCI Compliant?

The most critical security aspect is PCI compliance, since failing to follow these rules can result in legal action. PCI stands for The Payment Card Industry, and it is a group that is in charge of establishing electronic payment processing security standards. How you process credit card information and billing data can make or break your reputation and, consequently, your business.

PCI rules and practices must be followed by every company that accepts credit card payments. These requirements are set forth in the Payment Card Industry Data Security Standard (PCI DSS). The particular requirements that your company must adhere to are determined by its size, with the PCI providing four categories of business classification based on the number of transactions a company makes.

While all genuine processing companies must offer PCI compliant services, it’s still important to look into the PCI regulations for yourself since non-compliance might result in legal action. Inquire with your processing provider about how your company can meet the PCI compliance criteria.

SSL Certifications

If you are a business selling anything online, then you need to be aware of SSL protocol. SSL stands for secure sockets layer, a term used to refer to encryption technology for internet security. You’ve probably seen SSL in action without even recognizing it.

Making a note of whether a website’s URL begins with HTTPS is one way to detect if the site is utilizing SSL. An SSL certificate is installed if a website’s URL begins with HTTPS (not HTTP). That certificate serves as verification that the website employs SSL encryption. The small padlock icon to the left of the URL is another prominent symbol connected with SSL.

Customers that are familiar with SSL want to see HTTPS in the URL as well as the padlock, so make sure your website has one. There are a few options for doing this. You can create your website using a website builder that includes SSL certification; you can purchase an SSL certificate from a third-party vendor, or you can make use of your processing company’s payment gateway or payment page.

The majority of processing companies will provide an SSL-certified online payment interface. It is only if you have built your own website that you must ensure that it is secure.

Are You Using Tokenization?

Tokenization gives you an extra layer of security for your data protection. Tokenization is a service provided by certain payment processors that turns payment data into a random string of integers.

Tokenization is important because it essentially renders data unusable. Tokenized data would be entirely meaningless and worthless if a hacker had access to it, which makes this method one of the most trusted and secure payment processing features for a website. If you’re in search of a payment processor, be sure to inquire about tokenization since having added security is always a good idea.

Should You Be Using 3D Secure?

One of the best times to stamp out potential fraud is during the checkout process. When a customer purchases a product or service online, 3D secure provides another layer of authentication that requires interfacing with the cardholder’s bank.

If a customer is using a MasterCard, for instance, to purchase a product on your site, MasterCard would be the entity in charge of the final authentication step. These tests might include the use of pin codes and even biometric scans. You as the payment processor have no control over which method is used since it is handled by the bank.

This extra step helps make sure that the person using the card is the actual person to whom the card was issued. Some, but not all, payment processors offer this security feature.

Address Verification

Have you ever had to use a website to input your billing address? Your credit card is authenticated using your billing address. The transaction will go through if the billing address you supplied matches the one on file with your credit card company.

One of the most prevalent online payment security measures is the Address Verification Service (AVS). It is used by almost every processor since it’s simple to implement. Although it is not a flawless technique of avoiding fraud, it considerably reduces the chances of a fraudulent charge being accepted.

Conclusion

How you handle your payment processing can make or break your business. If you garner a reputation for poor security and fraud prevention and become known as a business that jeopardizes customer data and information during payment, people aren’t going to want to hand over this information. Keep the above considerations in mind and ensure your payment processing is easy, safe and trustworthy.

Continue Reading:

How does a Browser verify an SSL Certificate?

ABOUT THE AUTHOR

IPwithease is aimed at sharing knowledge across varied domains like Network, Security, Virtualization, Software, Wireless, etc.