Table of Contents

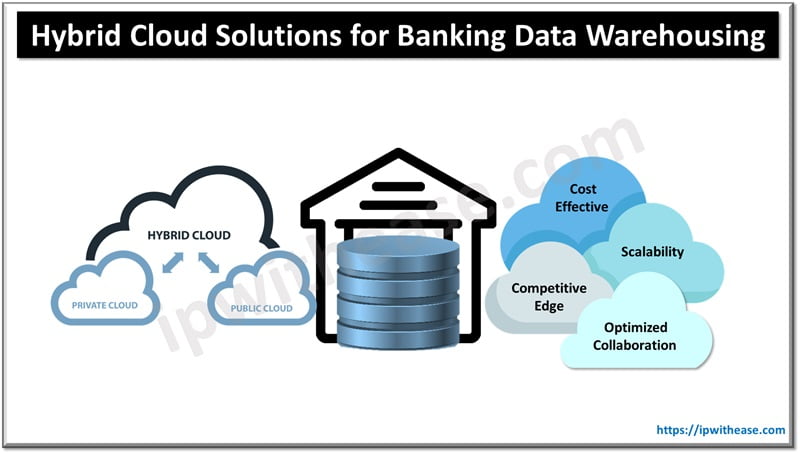

Studies show that cloud systems can save the IT sector in finance forty percent. Also, 90% of banks use cloud-based computing solutions. Despite such potential in hybrid cloud, 10% of sectors haven’t adopted this due to different myths and threats.

A hybrid cloud provides security and flexibility over the data. It also ensures disaster management by providing development and restoration options for the banking data warehouse.

Banking data warehouse development demands some protocols that should be met. It should be scalable with a massive database. Machine learning is also a plus point for this, as that would make the predictions and find potential frauds.

How Is This Useful in Banking?

Cost Effective

Hybrid cloud deployment would allow the banking sector to shift from an on-prem cloud to a virtual one. This would save many expenses and allow flexibility in resource management. In the hybrid cloud, you only pay for the services you use, freeing up physical infrastructure.

Scalability

Each firm wants scalability with time when customer acquisition increases. But this comes with many challenges, including handling computing hardware if it’s in an on-premise cloud. However, the hybrid cloud gives flexibility in scaling without any obstacles.

Competitive Edge

A hybrid cloud solution allows you to act swiftly over market changes. You can test different strategies without hectic infrastructure movement and make changes in ineffective ones. This would give you an edge over traditional competitors using private or on-prem cloud computing.

Optimized Collaboration

A hybrid cloud gives you much freedom to collaborate freely with other organizations without limitations of time and space. This would allow you to develop software compatible with all the major known platforms.

Best Use Cases of Hybrid Cloud in Finance

Storage

Banks can place big data in a third-party cloud without any security threat. On-premise cloud provides security against data theft, which can be removed by moving physical data from physical infrastructure to a digital hybrid cloud.

Data Recovery

There’s no security threat from disaster recovery. Banks can keep their production in the private or on-premise cloud and their recovery data in the hybrid cloud. This would mitigate the risk of losing data in case of any mishap in physical infrastructure.

Regulations

Banks face many regulatory challenges as laws differ in different locations. For example, different states have laws about data storage, which can be quickly dealt with if you have a hybrid cloud computing system.

Data Analysis

Banks use cloud analytics to analyze trends, make predictions, and extract customer experience patterns. Real-time data analysis helps banks retain customers and increase customer acquisition by understanding pain points and behavior. This would help build brand loyalty, which isn’t as effective in legacy infrastructure.

Best Practices

- Assess your Requirements: First, you must analyze your applications, software, data, and workloads. Then, analyze apps that should be on the private cloud and those that should be on the hybrid cloud. Before migrating, examine the risk to minimize hindrances.

- Safeguard the data: Prioritize the data protection first. Make the sensitive information encrypted and store it on a private cloud. Back up your data with safety measurements to a hybrid cloud. Cloud vendors provide built-in solutions for backing up and restoring lost data.

- Selecting Type Of Architecture: Banks shifting to hybrid should take time to prepare their apps for changes. Cloud-based apps are more accessible to monitor, maintain, and manage than traditional apps. Also, from the start, decide which architecture type you want to opt for when making software for the cloud. Though monolithic is the default architecture for building software, the search for microservices has increased to more than double in a decade.

- Opting Cloud Provider: Top cloud vendors include AWS, Google Cloud, Microsoft Azure, and Adobe. They provide unified and personalized tools and collaborate with financial software providers to shift from physical on-premise clouds to public ones.

Cloud Service Models

The smooth and steady cloud deployment requires attention to your bank’s best cloud service model. Here are four types of models that you can opt for:

Software-as-a-Service (SaaS)

SaaS model provides software applications where you don’t need to install or maintain anything.

Examples of this type include Gmail, Microsoft Office Online, and Salesforce.

Business Process-as-a-Service (BPaaS)

This model offers complete business processes as a service where the provider takes care of everything.

It would include Payroll processing, accounting services, customer service, etc.

Platform-as-a-Service (PaaS)

This model provides a complete platform for developers to build, run, and manage applications, with a virtual workshop with all the necessary tools.

This includes Google App Engine, Microsoft Azure, and Heroku.

Infrastructure-as-a-Service (IaaS)

This model provides virtualized computing resources to create and manage your servers, storage, and networking.

This includes Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform.

Conclusion

Like every progressive bank, migration to a hybrid cloud would be inevitable. It provides scalability and flexibility with many other benefits, including regulatory compliance. Every bank should enjoy total leverage over the on-prem cloud and maximize the user experience.

Every institution, including banks, should embrace this change and fully utilize it. The main purpose of the public cloud is to provide access to SaaS products across the board.

ABOUT THE AUTHOR

IPwithease is aimed at sharing knowledge across varied domains like Network, Security, Virtualization, Software, Wireless, etc.