Table of Contents

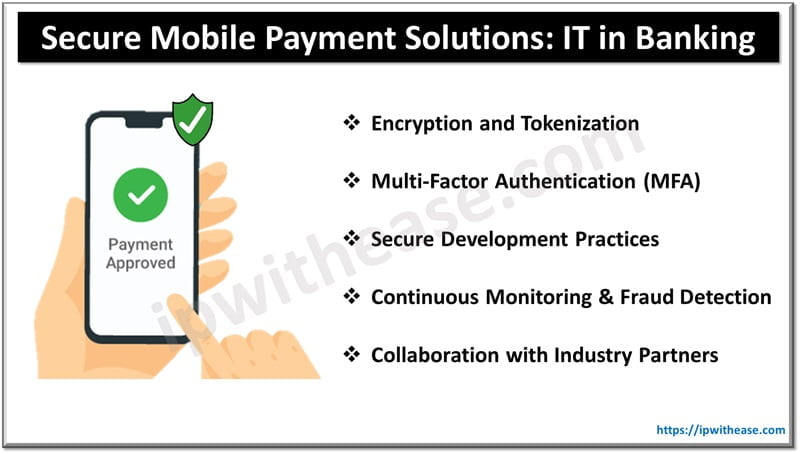

With the widespread adoption of smartphones and the growing preference for cashless transactions, banks are increasingly focusing on developing secure mobile payment solutions. However, ensuring the security of these platforms is paramount to safeguarding customer data and preventing fraudulent activities. Let’s explore the key strategies that banks can employ to build robust and secure mobile payment solutions.

Key Strategies of Deploying IT in Banking

Encryption and Tokenization

Incorporating robust encryption algorithms and tokenization methods is vital for safeguarding sensitive data like credit card information and personal identifiers during mobile transactions. By encrypting data in transit and at rest, banks can mitigate the risk of unauthorized access and data breaches. Moreover, leveraging advanced encryption standards like AES (Advanced Encryption Standard) and adopting tokenization methods where sensitive data is replaced with non-sensitive tokens further fortifies the security of mobile payment platforms.

Related: What is Encryption? Detailed Explanation

Multi-Factor Authentication (MFA)

Integrating MFA mechanisms, such as biometric authentication, SMS codes, or one-time passwords, adds an extra layer of security to mobile payment apps. By employing this method, the risk of unauthorized access is minimized, even in cases where login credentials are compromised, thus bolstering the platform’s overall security. Additionally, implementing adaptive authentication techniques that dynamically adjust the level of authentication based on risk factors and user behavior enhances the effectiveness of MFA in thwarting unauthorized access attempts.

Secure Development Practices

Adopting secure coding practices and conducting regular security audits are crucial steps in building resilient mobile payment solutions. Banks must adhere to industry best practices and standards, to identify and address security vulnerabilities throughout the development lifecycle. Moreover, integrating security into the DevOps pipeline through practices like DevSecOps ensures that security is ingrained into every stage of the software development process, thereby reducing the risk of introducing vulnerabilities into the mobile payment platform.

It’s advisable to hire a skilled development team proficient in secure coding practices which allows for the execution of these measures effectively and ensures the robustness of the mobile payment solution.

Continuous Monitoring and Fraud Detection

Banks should deploy advanced monitoring tools and machine learning algorithms to detect suspicious activities and anomalies in real time. By analyzing transaction patterns and user behavior, banks can identify potential security threats and take proactive measures to prevent fraud. Furthermore, leveraging artificial intelligence and data analytics capabilities enables banks to enhance their fraud detection capabilities by identifying emerging fraud patterns and adapting their security controls accordingly.

Collaboration with Industry Partners

Collaborating with technology vendors, payment networks, and regulatory bodies is essential for banks to stay abreast of emerging threats and regulatory requirements. By sharing threat intelligence and best practices, banks can collectively strengthen the security posture of mobile payment ecosystems. Additionally, participating in industry forums and consortiums allows banks to collaborate with peers and industry stakeholders to address common security challenges and develop standardized approaches for mitigating risks in mobile payments.

This collaborative approach fosters a culture of information sharing and cooperation within the financial industry, enabling banks to leverage collective expertise and resources to tackle evolving cyber threats effectively. Furthermore, engagement with regulatory bodies ensures compliance with industry standards and regulations, promoting transparency and accountability in mobile payment security practices. By actively engaging in collaborative efforts, banks can enhance the resilience of mobile payment ecosystems and uphold customer trust in digital financial services.

Continue Reading:

Top 5 Data Breaches in Cyber Security and Possible Preventative Measures

What is Data Loss Prevention (DLP)? Techniques & Best Practices

ABOUT THE AUTHOR

IPwithease is aimed at sharing knowledge across varied domains like Network, Security, Virtualization, Software, Wireless, etc.